Secure, domain-tuned AI platform purpose-built for insurance

enterprises.

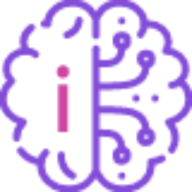

Own your LLM, lower costs, and deploy AI your way.

Lightweight AI for basic automation

Full-scale document and claims intelligence

Understands text, images, documents, voice

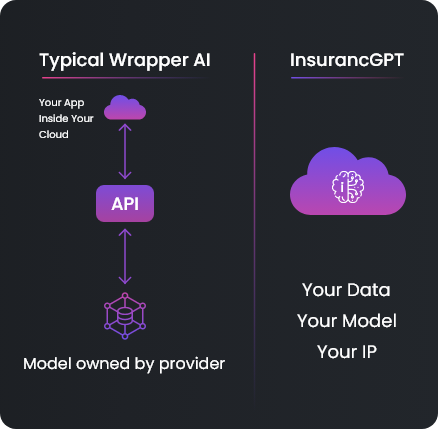

InsurancGPT is agentic by design, fine-tuned for insurance, and gives your enterprise the power to train, deploy, and evolve your own private AI assistant.

Policy & document intelligence

Fast-track FNOL and claims automation

Virtual support for customers and employees

Compliance & regulatory monitoring

Smart quoting powered by public + internal data

Predict churn and improve renewals

Accelerate underwriting with risk analysis

Lead scoring and follow-ups in drop-off journeys

| Feature | Third-Party APIs | Enterprise Cloud AI | InsurancGPT |

|---|---|---|---|

| Data Control | External | Cloud-locked | Full ownership |

| IP Ownership | Vendor owns model | Shared | Yours entirely |

| Cost Structure | Per-token fees | Token/Pay-per-use | Predictable, fixed |

| Domain Fit | Generic | Semi-custom | Trained on insurance |

| Compliance | Varies | Shared logs | Private & audit-ready |

20% to 50% lower total cost compared to traditional API-based AI solutions.

Keep your sensitive data within your own environment.

The model learns from your data—only for your benefit.

15% higher conversions with AI-powered marketplace, real-time insights, smart agent selection, and document intelligence.

45% better underwriting accuracy, 60% faster quoting & binding with AI powered automation and insights.

ROI Calculator and Evaluation – Our proprietary ROI

calculator assesses financial and operational impact,

ensuring AI investments deliver measurable value.

Responsible AI Framework – We ensure fairness, transparency, privacy, and ethical compliance by embedding Responsible AI principles throughout the solution.

AI Performance Monitoring – Our web app tracks usage, performance, and interactions while ensuring accuracy, relevance, and compliance.

Data Foundation Analyzer – Our tool assesses, visualizes, and optimizes data quality, structure, and readiness for AI-driven insights.

Pre-Trained AI Models – Our ready-to-use models, fine-tuned for industry needs, significantly reduce time-to-market and enhance AI performance

InsurancGPT is a proprietary language model built specifically for the insurance industry. Unlike generic AI models, it understands underwriting, claims, policy language, compliance, and fraud detection. InsurancGPT automates complex workflows such as pre-filling underwriting data, analyzing claims, detecting fraudulent behavior, and assisting with regulatory documentation. It ensures insurers maintain full control of their data, model weights, and intellectual property, which eliminates risks associated with third-party APIs. By combining insurance expertise with AI innovation, InsurancGPT delivers superior accuracy, transparency, and cost efficiency compared to off-the-shelf language models.

Regulatory compliance is a core design principle of InsurancGPT. The model is trained and fine-tuned to understand NAIC, HIPAA, GDPR, and AI Act requirements, ensuring outputs align with strict insurance regulations. It enables insurers to document decisions transparently, generate explainable outputs, and maintain clear audit trails for regulatory reviews. Unlike black-box AI tools, InsurancGPT integrates explain ability features such as SHAP values to show why predictions were made. This reduces compliance risks while giving insurers confidence that AI-driven workflows meet both industry and government standards, making InsurancGPT a secure and compliant choice.

"No APIs. No lock-ins. Just your own insurance-tuned intelligence."